Breaking Down Fees & Exchange Rates

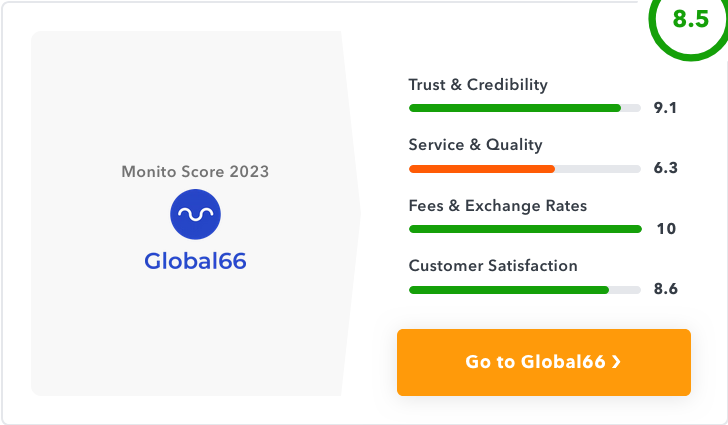

Fees & Exchange Rates is Monito's comparison engine has revealed Remitly, Wise and Global66 to be the lowest priced money transfer services based on data collected from hundreds of thousands of searches on Monito: Remitly is by far the leader. Wise comes in second while Global66 takes third.

Remitly was found to be most cost-effective and competitive on 15% of available Monito searches for bank transfers and 64% for cash pickups for all 12 months in 2022; whilst Wise found itself most cost-effective and competitive for 19% of available searches for bank transfers;

Global66 ranks first for bank transfer searches across 10 of 12 months of 2022 on Monito's search platform.

Worthy Mentions and Special Considerations

Money transfer services that offer competitively-priced transfers may vary significantly by region; thus services that specialize in specific corridors may not appear among our global results above.

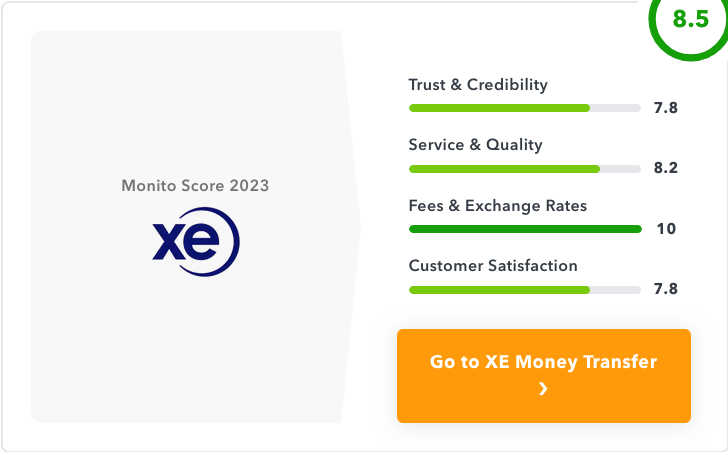

SingX is often the lowest-priced and most competitive service for transfers from Singapore, Hong Kong and Australia; sometimes even more so than Wise or Remitly. When it comes to Switzerland transfers, specialist services b-sharpe and Wise often provide the most economical rates, while for transfers from UK to Poland transfers TransferGo often comes out ahead (although XE Money Transfer may offer similar favourable terms.)

WorldRemit should also be mentioned, as they were found to be the cheapest provider in 15% of available Monito searches for cash pickups but did not make the top three list.

To address this challenge and ensure you're finding the best offer for your specific transfer corridor, we recommend running a search on Monito's real-time comparison engine. Break It Down By Customer Satisfaction

At Monito, the top money transfer services ranked by customer satisfaction are Paysend, Wise and XE Money Transfer; all three services have consistently impressed their customers based on metrics including:

Paysend: 89% of 23 thousand customers who provided feedback via Trustpilot gave the service five out of five stars; Wise: Around 88% of 116 thousand customers gave feedback through Trustpilot rated Wise five stars out of five;

XE Money Transfer: of over 45,000 customers who provided reviews on Trustpilot, 95% gave five out of five star ratings to XE.

Worthy Mentions and Special Considerations

Many services on Monito are highly rated by customers, narrowly missing making it into the top three - examples being TransferGo (9.6/10), Azimo (9.6/10) and Remitly (9.5/10).